Honda Hits the Brakes on All-EV, Slams the Gas on Hybrids

The Scoop – Facing cooler EV demand and tariff turbulence, Honda is trimming ¥3 trillion ($21 B) from its electrification budget, lowering its 2030 EV-sales target to 20 % and promising 13 next-gen hybrids plus an in-house “zero-fatality” ADAS suite by 2030.

Why It Matters – Hybrids just got a fresh vote of confidence. Suppliers tied to motors, inverters and battery packs for parallel/series systems could enjoy a second wind, while pure-play EV players may feel the headwind.

Our Take – Honda’s pivot is a reminder that the near-term market still values flexibility and affordability. Expect other hesitant OEMs to copy-paste portions of this “hybrid hedge” until charging infrastructure and policy signals firm up.

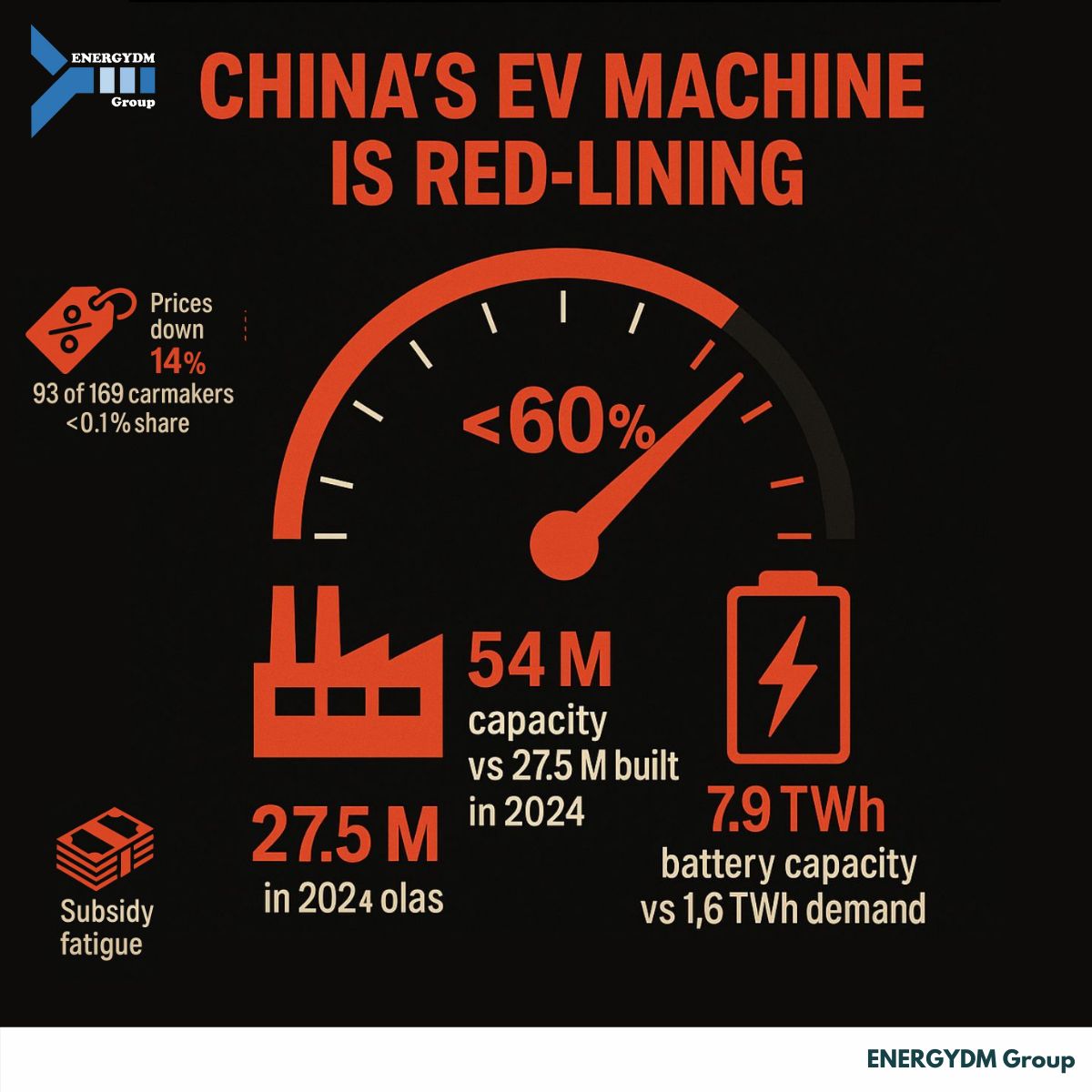

BYD Plants Its Flag in Budapest

The Scoop – China’s BYD will spend roughly HUF 100 B (≈ €250 M) on a European headquarters and R&D hub in Hungary, creating 2,000 jobs and adding certification, design and after-sales engineering to its local toolbox.

Why It Matters – Europe just became BYD’s backyard. A permanent base slashes logistics costs, speeds model localisation and gives the brand a louder voice in Brussels as tariff debates heat up.

Our Take – Expect faster refresh cycles tailored to EU tastes (think compact crossovers, right-size batteries) and stiffer price pressure on VW Group, Stellantis and Renault as BYD shortens supply lines and leans on subsidies.

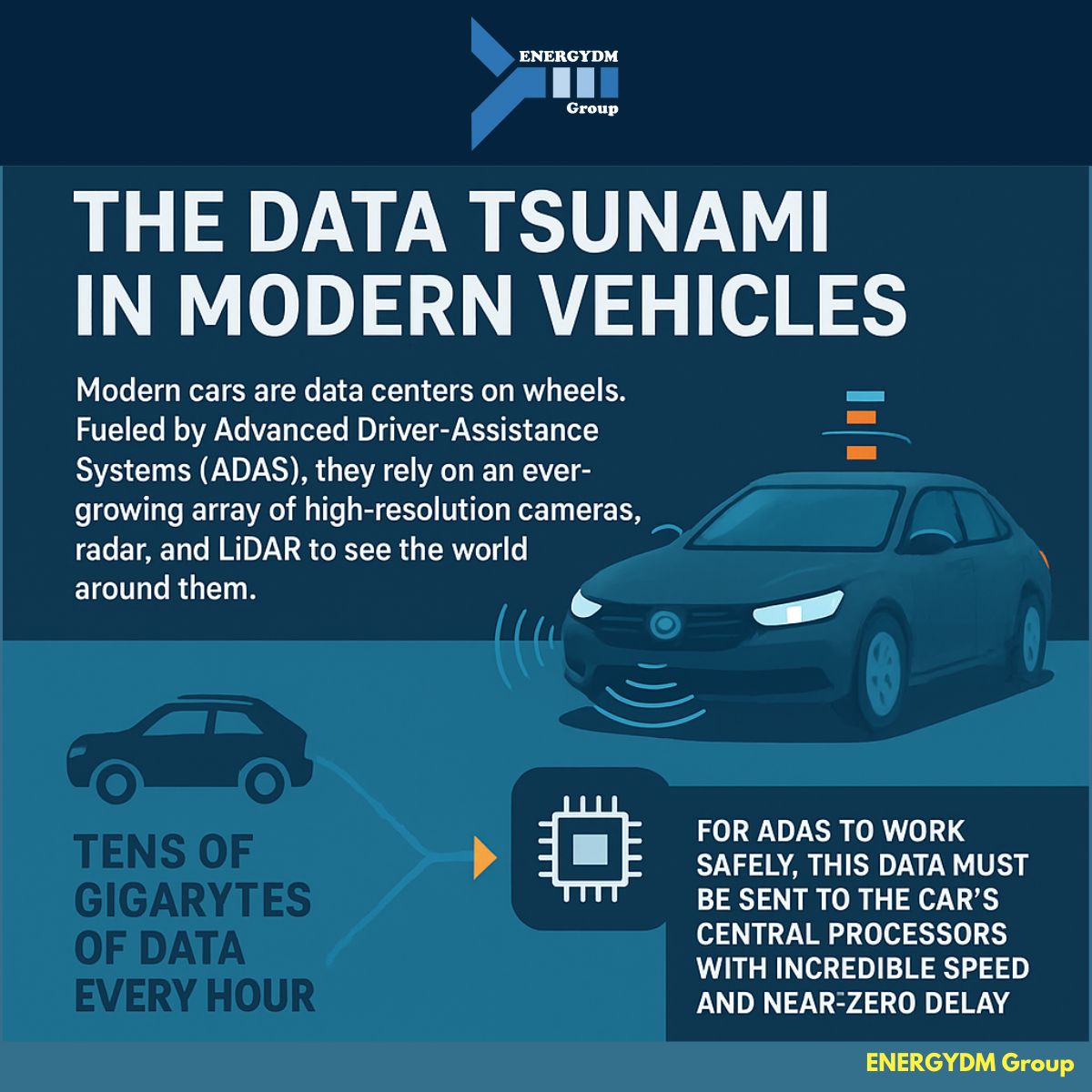

Waymo’s Robotaxis Win a Bigger Sandbox

The Scoop – California regulators okayed Waymo’s fare-charging service to sprawl beyond San Francisco into the Peninsula and San Jose, solidifying the Alphabet unit as the only U.S. operator running truly driverless, paid rides at scale (≈ 250 k trips per week).

Why It Matters – Each new zip code boosts real-world data, revenue and consumer trust—critical for amortising those pricey sensor stacks before rivals (Tesla, Cruise 2.0, Zoox) claw back market share.

Our Take – Watch for spill-over effects: city councils will fast-track curb-space rules, insurers will refine AV risk models, and mobility apps (Uber, Lyft) may double down on AV partnerships rather than build in-house tech.

XPeng Drops the LiDAR, Keeps the Magic

The Scoop – The Mona M03 Max bowed in China with a pure-vision “Turing” autonomy stack, dual NVIDIA Orin-X chips and 580 km CLTC range—all for a shockingly low ¥155,800 (~$21.5 k).

Why It Matters – If XPeng’s camera-only system nails urban driving, it undercuts LiDAR BOM costs by hundreds of dollars per car, pressuring global OEMs to re-run their sensor ROI math.

Our Take – Expect a heated “LiDAR vs. Vision-only” rematch. Tier-1 suppliers may hedge by offering modular sensor suites, letting OEMs toggle LiDAR on pricier trims while mass-market cars lean on cameras.

BMW Rolls Out a Solid-State Test Mule

The Scoop – BMW and Solid Power have slipped large-format all-solid-state cells into a road-going i7 prototype, promising higher energy density and longer range with quicker charging. On-road testing around Munich starts this month.

Why It Matters – Solid-state tech is the industry’s “holy grail.” Demonstrating durability and safety outside the lab is the final hurdle before 2030 mass production targets.

Our Take – If early data look good, watch battery-metal forecasts pivot from graphite to solid electrolytes and dry-coating processes. This could also push rivals (Toyota, Hyundai) to accelerate their own ASSB pilots.

CATL Bags 2025’s Biggest IPO—& a War Chest for Europe

The Scoop – Battery colossus CATL raised $4.6 B in a Hong Kong listing and popped 16 % on day one, earmarking cash for a Hungarian megafactory supplying BMW, VW and Stellantis.

Why It Matters – New capital plus an EU footprint tighten CATL’s grip on global cell supply just as North American and European OEMs scramble for non-Chinese alternatives amid tariff volleys.

Our Take – Short-term, expect even fiercer price competition in LFP and NMCA chemistries. Long-term, Western policy makers may double down on “friend-shoring” incentives to blunt CATL’s scale advantage.

The road ahead is anything but boring—hybrids are fashionable again, robo-taxis keep multiplying, and the battery race just entered overtime.

Which story sparks your curiosity?