Your cart is currently empty!

NVIDIA’s Automotive Strategy and Market Position – What 5/28/2025 Earnings Report Means to its Automotive Business

Posted by:

|

On:

|

NVIDIA has firmly positioned itself as a leader in automotive AI compute by offering a full-stack “cloud-to-car” platform. Its DRIVE platform (powered by Orin and upcoming Blackwell GPUs), the safety-certified DriveOS operating system, and supporting tools (DGX for training, Omniverse/Cosmos for simulation) form a comprehensive SDV (software-defined vehicle) ecosystem [1].

In practice, many major OEMs have adopted or announced plans to use NVIDIA’s technology: for example, Toyota will build its next-gen vehicles on DRIVE AGX Orin with DriveOS [2], and General Motors will use NVIDIA DRIVE AGX (on the new Blackwell architecture) to power future electric/automated vehicles [3].

Other high-profile partners include Volvo Cars (using DRIVE AGX in new EVs) [4], Mercedes-Benz, Jaguar-Land Rover, Li Auto, Lucid, BYD, NIO, Rivian, Zoox and others [2].

On the Tier-1 side, suppliers like Magna and Continental are integrating NVIDIA compute into their products (e.g., Magna will deploy DRIVE Thor SoCs for L2–L4 ADAS [6], and Continental plans to mass-produce NVIDIA-powered L4 self-driving trucks with Aurora [7]).

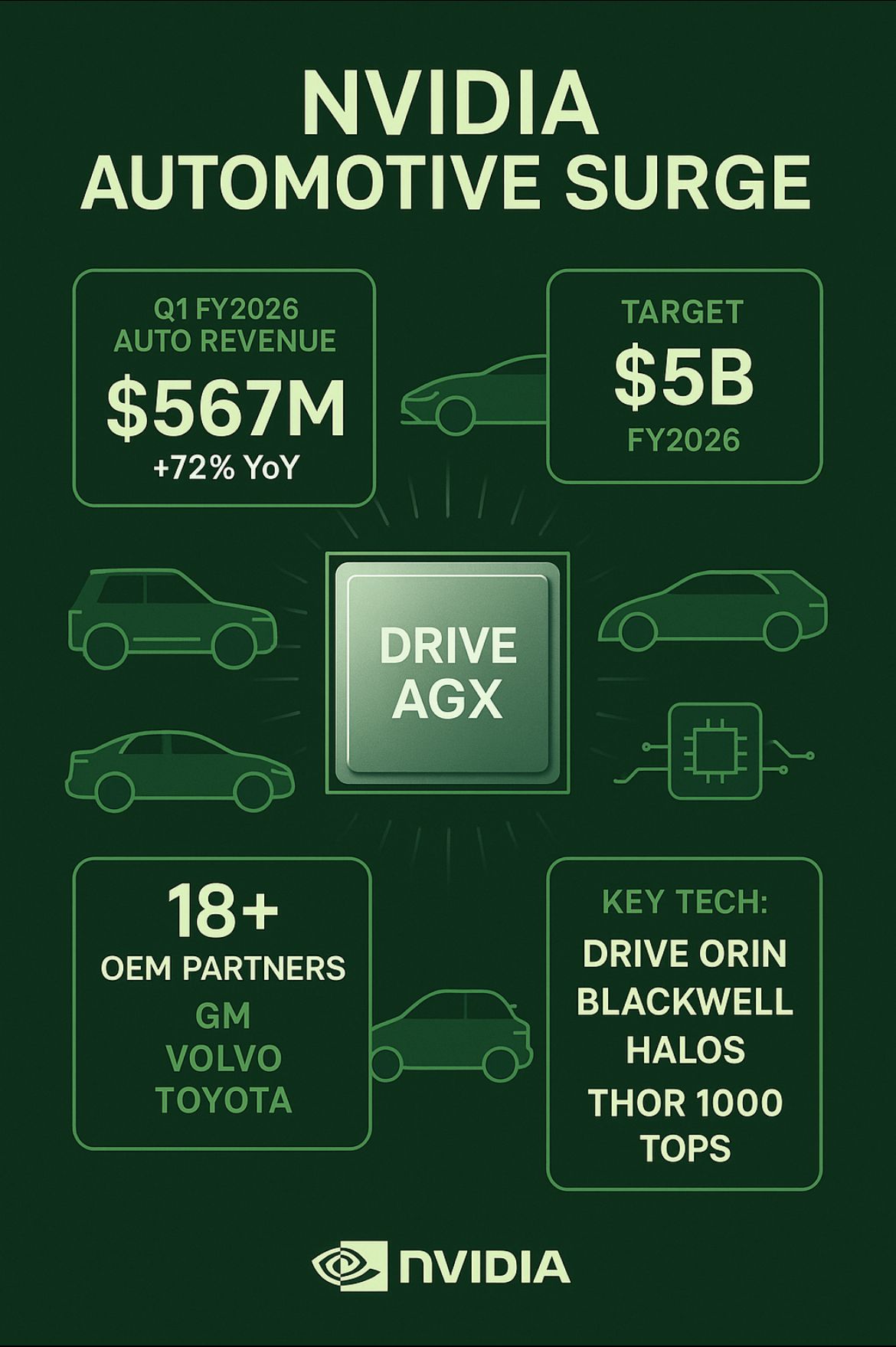

NVIDIA reports that the majority of automakers, Tier-1s and AV startups are building on its DRIVE AGX platform, and it targets roughly $5 billion in automotive revenue for FY 2026 [2].

Recent ADAS and SDV Technology Developments

NVIDIA and partners have announced several notable advances in ADAS and software-defined vehicles. In March 2025, NVIDIA launched “Halos,” a full-stack safety system for autonomous vehicles [1]. Halos unifies hardware, software and AI-based safety technologies from cloud training through in-car compute, and it is complemented by the AI Systems Inspection Lab unveiled at CES 2025 to help OEMs verify their AV software stacks [8].

OEMs are simultaneously adopting centralized computing architectures. NVIDIA executives note that compute requirements continue to soar well beyond early targets, pushing the company to its next-gen Blackwell-based chips; GM plans to use this platform in future vehicles [3]. At GTC 2025, NVIDIA and GM also announced Omniverse/Cosmos collaboration for factory planning [3]. Volvo Cars likewise relies on dual DRIVE AGX Orin configurations in its ES90 EV and uses DGX servers for training safety models [4]. In short, the last quarter has seen NVIDIA double down on autonomous and advanced-driving initiatives—unified safety stacks (Halos), massively more compute (Blackwell/Thor), and deeper cloud-to-car collaborations that align with the emerging SDV paradigm [1], [3], [4].

Q1 FY 2026 Automotive Segment Results and Trends

In Q1 FY 2026 (ended 27 Apr 2025), NVIDIA’s Automotive & Robotics segment reported $567 million in revenue [10]. That was essentially flat (-1 %) sequentially versus Q4 FY 2025’s $570 million [11] but up 72 % year-over-year [10]. By contrast, FY 2025 Automotive revenue was $1.7 billion (+55 % YoY) [11], so the segment continues a multi-quarter surge.

The trajectory (Q1 FY25 ≈ $330 M → Q4 FY25 $570 M → Q1 FY26 $567 M) underscores rising content per vehicle. Management still sees a multiyear upswing as vehicles become “functionally safe, advanced driving assistance” platforms, though Automotive remains only a few percent of total company sales [2].

Competitive Landscape: Qualcomm, Horizon, NXP, Tesla

Qualcomm has aggressively expanded in cars: at CES 2025 it announced deals with Leapmotor, Mahindra & Mahindra and Hyundai Mobis for its Snapdragon Ride/Digital Chassis platforms [12]. Analysts note, however, that while Qualcomm’s hardware and partnerships are strong, its software stack still trails incumbents [13]. NVIDIA’s DriveOS, already certified to ASIL-D safety [14], is a differentiator for higher-level autonomy.

Chinese startup Horizon Robotics is rising quickly, especially after an April 2025 strategic partnership with Denso to co-develop high-performance ADAS solutions [15]; yet its reach remains mostly regional. Traditional supplier NXP continues to supply MCUs, radar and networking but saw its automotive revenue fall ≈ 6 % YoY in Q4 2024 amid inventory overhang [16]. Tesla designs its own FSD chips, making it more a rival than a customer. Overall, NVIDIA’s chief compute rivals are Qualcomm and Mobileye rather than legacy auto chipmakers.

Growth Outlook and Forecasts

NVIDIA reiterates its ≈ $5 billion FY 2026 automotive revenue target [2]. Industry analysts likewise forecast robust demand: Persistence Market Research projects the global automotive-semiconductor market will grow from ~$57 billion in 2023 to $95 billion by 2030 (≈ 7.5 % CAGR) [18]. A Reuters Breakingviews note highlighted NVIDIA’s 72 % YoY automotive jump as evidence it could become a key beneficiary of AI-driven vehicles [19].

Key Automotive Customers and Tier-1 Partners

| Company | Type | NVIDIA Solution / Use Case |

|---|---|---|

| Toyota | OEM | Next-gen vehicles on DRIVE AGX Orin with safety-certified DriveOS [2] |

| General Motors | OEM | Future EVs & robots using DRIVE AGX (Blackwell) and Omniverse/Cosmos [3] |

| Volvo Cars | OEM | Dual DRIVE AGX Orin in ES90; DGX servers for training safety models [4] |

| Mercedes-Benz, JLR, Li Auto, Lucid, BYD, NIO, Rivian, Zoox, Xiaomi, ZEEKR | OEMs | Building on NVIDIA DRIVE platform [2] |

| Magna | Tier-1 | Integrating DRIVE Thor SoC for L2+–L4 ADAS & cabin AI [6] |

| Continental | Tier-1 | Mass-producing L4 driverless-truck systems with Aurora Driver + DRIVE Thor [7] |

| Bosch, Aptiv, Denso (via Horizon) | Tier-1 | Various ADAS/SDV modules leveraging NVIDIA compute |

Impact of Partnerships (Chip Foundries & Tier-1s)

Manufacturing capacity. In April 2025 NVIDIA said it will work with TSMC, Foxconn, Wistron and others to build AI servers worth up to $500 billion in the U.S. over four years [17]. On-shoring advanced packaging and assembly helps derisk supply for automotive SoCs.

Tier-1 distribution. Deals with Magna and Continental embed DRIVE silicon inside widely marketed modules, turning NVIDIA compute into built-in content rather than optional add-ons [6], [7]. The combination of secured manufacturing and deep Tier-1 channels strengthens NVIDIA’s bid for a dominant share of the next wave of automotive AI compute.

Conclusion

NVIDIA’s Q1 FY 2026 results confirm that its automotive business is evolving from an R&D showcase into a material revenue engine. A 72 % year-over-year jump to $567 million indicates that OEM production programs based on DRIVE Orin are finally hitting scale [10]. With a clear roadmap—Blackwell-class SoCs, Thor domain controllers, and the Halos safety stack—NVIDIA is positioned to ride the automotive-semiconductor market’s projected surge to ≈ $95 billion by 2030 [18]. Crucially, its cloud-to-car strategy creates switching costs that rivals must match not only in silicon performance but in simulation, safety certification, and over-the-air software infrastructure.

Execution risks remain. Qualcomm’s aggressive Digital Chassis push, Horizon Robotics’ localization advantage in China, and Tesla’s in-house FSD compute all chip away at addressable share. Regulatory headwinds, functional-safety thresholds, and supply-chain build-outs add further complexity. Yet NVIDIA’s growing lattice of OEM and Tier-1 partnerships—now covering everything from mass-market Toyotas to premium Volvos and Magna’s turnkey ADAS modules—gives it a diversified path to volume.

If management delivers on its ≈ $5 billion FY 2026 automotive target [2], NVIDIA will have transformed itself from “GPU company dabbling in cars” to a cornerstone supplier of the software-defined vehicle era. The next 18 months will show whether its holistic, AI-centric approach can outpace competitors and cement a leadership position in what could be the decade’s most lucrative silicon battleground.

References

[1] NVIDIA Blog, “NVIDIA Halos: A Full-Stack, Comprehensive Safety System for Autonomous Vehicles,” Mar. 18 2025.

[2] NVIDIA Press Release, “Toyota, Aurora and Continental Join Growing List of NVIDIA Partners Rolling Out Next-Generation Highly Automated and Autonomous Vehicle Fleets,” Jan. 6 2025.

[3] NVIDIA Newsroom, “General Motors and NVIDIA Collaborate on AI for Next-Generation Vehicle Experience and Manufacturing,” Mar. 18 2025.

[4] Volvo Cars Press Release, “The new, fully electric ES90 – defined by software and built on our Superset tech stack,” Feb. 20 2025.

[5] (duplicate reference consolidated into [2]).

[6] Magna Press Release, “Magna and NVIDIA Team Up to Advance Next-Gen Automotive Technologies,” Mar. 12 2025.

[7] Continental Press Release, “Aurora, Continental and NVIDIA Partner to Deploy Driverless Trucks at Scale,” Jan. 6 2025.

[8] NVIDIA Blog, “NVIDIA Launches DRIVE AI Systems Inspection Lab, Achieves New Industry Safety Milestones,” Jan. 6 2025.

[9] (absorbed into [8]).

[10] NVIDIA Press Release, “NVIDIA Announces Financial Results for First Quarter Fiscal 2026,” May 28 2025.

[11] NVIDIA Press Release, “NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2025,” Feb. 26 2025.

[12] Qualcomm Press Release, “Qualcomm Brings Industry-Leading AI Innovations and Broad Collaborations to CES 2025,” Jan. 6 2025.

[13] JPR Analysis, “Qualcomm expands its automotive footprint at CES 2025,” Jan. 8 2025.

[14] NVIDIA Press Release, “NVIDIA DRIVE Hyperion Platform Achieves Critical Automotive Safety and Cybersecurity Milestones,” Jan. 6 2025.

[15] PR Newswire, “Horizon Robotics and DENSO Forge Strategic Partnership to Accelerate Adoption of High-Performance Assisted Driving,” Apr. 25 2025.

[16] NXP Press Release, “NXP Semiconductors Reports Fourth Quarter and Full-Year 2024 Financial Results,” Feb. 3 2025.

[17] Reuters, “Nvidia plans to build AI servers worth up to $500 billion in U.S. over next four years,” Apr. 14 2025.

[18] Persistence Market Research, “Global Automotive Semiconductor Market to Reach $95 Billion by 2030,” Nov. 21 2023.

[19] Reuters Breakingviews, “Nvidia’s next move is to hit the road,” Nov. 22 2024.

Posted by