1. China Tightens Rules on Autonomous Driving Software

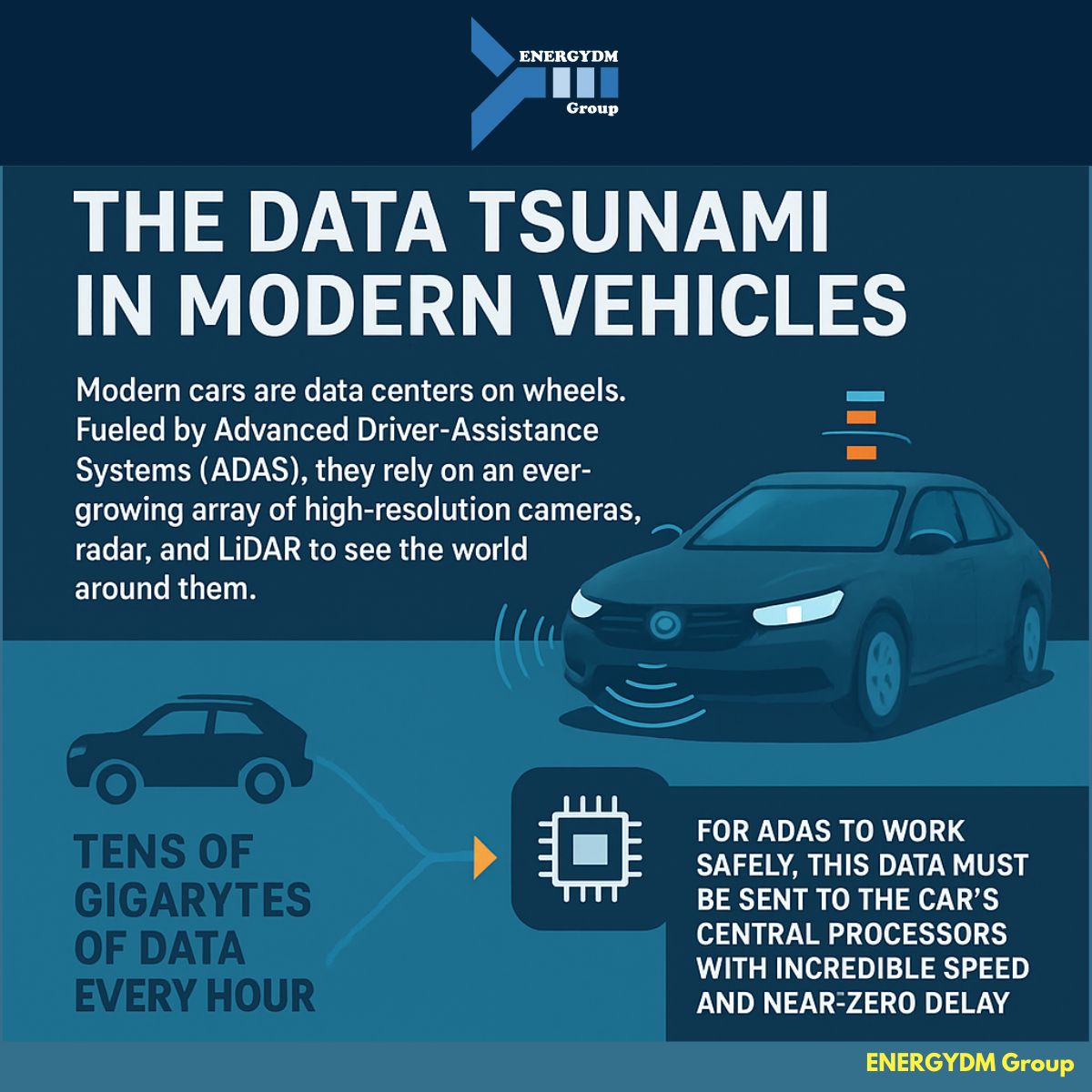

The Scoop: China has introduced new regulations requiring carmakers to get official approval before rolling out software updates for autonomous driving features. This move aims to improve safety and accountability, making sure that critical ADAS (advanced driver-assistance systems) releases get proper oversight.

Why It Matters: By treating OTA (over-the-air) software updates like traditional recalls, China is signaling that safety is principal — even in the digital domain. With autonomous tech evolving rapidly, regulators want to prevent misleading marketing claims about “self-driving” capabilities and ensure that any issues get addressed immediately.

Our Take: We can expect global ripple effects. Automakers everywhere might adopt stricter processes for ADAS releases to stay compliant in one of the biggest car markets. Ultimately, more rigorous testing and transparency could boost consumer trust in self-driving cars — this is a true win-win.

Source: Reuters: China’s New Rules on Autonomous Driving

2. The EU’s Big Push for EV Adoption & Local Batteries

The Scoop: The European Union is rolling out an all-encompassing plan to electrify its vehicle fleets, expand charging networks, and incentivize local battery production. New measures will support corporate fleet electrification, reduce road charges for zero-emission trucks, and strengthen supply chains by encouraging European-made battery cells.

Why It Matters: EV sales in Europe dipped slightly last year, partly due to inconsistent infrastructure and changing subsidies. This plan aims to reverse that trend by making zero-tailpipe emission vehicles more attractive and making sure the battery supply chain is secure (and less dependent on imports).

Our Take: If this plan is successful, we’ll see a more integrated EV market with consistent charging options across borders. As Europe streamlines everything from incentives to battery production, legacy carmakers will have to accelerate their electrification timelines to stay competitive.

Source: Automotive News Europe: EU’s Draft EV Action Plan

3. GM’s Major EV Sales Surge

The Scoop: General Motors reported a big leap in U.S. EV market share—doubling its slice to about 12% in the last quarter. Models like the Cadillac Lyriq and Chevy Equinox EV have helped GM become Tesla’s closest challenger at home.

Why It Matters: Cracking Tesla’s dominant EV position isn’t easy, but GM’s diverse lineup is resonating with mainstream buyers who want multiple price points and styles. However, looming shifts in U.S. politics, and its potential cutbacks on federal EV subsidies. It may test GM’s new momentum.

Our Take: GM’s strategy of offering EVs in different segments (luxury, budget-friendly, SUVs, crossovers) seems spot on. Keep an eye on how policy changes could impact pricing and adoption. If incentives shrink, GM might need to pivot on cost structure to keep these new EVs competitive.

Source: Bloomberg: GM’s EV Market Share Gains

4. SAIC & Huawei Team Up for “Smart EVs”

The Scoop: China’s state-owned SAIC Motor has struck a major partnership with tech giant Huawei to create globally competitive electric vehicles. By combining SAIC’s manufacturing and Huawei’s talent in autonomous driving software, they aim to produce EVs loaded with advanced connectivity and self-driving features.

Why It Matters: Deep integration between a car manufacturer and a tech firm can speed up innovation. Both companies bet that future car sales hinge on who offers the smartest, most intuitive in-car experience, from infotainment to semi-autonomous driving.

Our Take: We’ve seen similar tie-ups (like Huawei with BAIC and Changan), and it’s a clear trend: auto and tech coming together to tackle an increasingly software-driven industry. Expect more such alliances that blur the lines between “automaker” and “tech provider.” Similar alliances are in development in the American market too.

Source: TechCrunch: SAIC & Huawei Collaboration

5. XPeng’s G6 SUV: Upgraded ADAS & Lightning-Fast Charging

The Scoop: Chinese EV startup XPeng revealed its G6 SUV with an “AI Turing” intelligent driving system. The vehicle rides on an 800V platform for ultra-fast charging, cutting charging times and offering enhanced autonomy features to compete with global rivals.

Why It Matters: XPeng’s continuous push into advanced driver-assist tech keeps it in the fast lane of the Chinese EV market, and already the world’s largest. As XPeng eyes international expansion, these high-tech upgrades could help the brand stand out against Tesla, NIO, and traditional automakers.

Our Take: Consumers increasingly factor in how fast they can recharge and how advanced the ADAS system is before buying an EV. XPeng’s approach, bundling cutting-edge AI with speedy charging, could inspire other manufacturers to up their game.

Source: InsideEVs: XPeng G6 Upgrade

6. Brazil’s Booming EV Market

The Scoop: Brazil’s electric vehicle sales are skyrocketing. It was up nearly 89% last year. Chinese automakers like BYD and Great Wall Motor are investing heavily, while local charging infrastructure is also picking up speed, tripling in some regions. Over 82% of the EV sold in Brazil are from Chinese manufacturers.

Why It Matters: Latin America’s largest economy is becoming an attractive new frontier for global EV players. This surge in demand is fueled by a broader range of EV models, more brand competition, and growing consumer awareness of eco-friendly options.

Our Take: High import tariffs used to slow EV adoption in Brazil, but robust consumer interest and new local assembly plans (especially by Chinese automakers) are changing the landscape. A increasing market here could reshape EV strategies in the rest of Latin America, opening a new battleground for electric car brands worldwide. Similarly, this EV boost will happen to the heavy-duty industry, including semi-truckers, trailers, city buses, etc.

Source:Reuters: Brazil EV Market Growth

Final Thoughts

From China’s tightening regulations on self-driving updates to the EU’s EV push, GM’s rising momentum, mega-partnerships, and Brazil’s budding EV fever, these developments highlight the global nature of today’s automotive evolution. Whether it’s software-driven vehicles or major policy boosts, the common thread is innovation powering the road ahead.

Buckle up—this ride is only getting started!

Which news do you think will shake up the global auto industry the most? Share your thoughts below!