In a major shake-up of the automotive tech landscape, Volkswagen Group and Rivian have teamed up to develop the “brains” of their future electric vehicles. In November 2024, the two companies officially launched a joint venture aimed at creating next-generation vehicle software and electronic architectures. Volkswagen is committing up to $5.8 billion to this partnership—a massive vote of confidence in Rivian’s technology. The goal is to combine Volkswagen’s global scale with Rivian’s software prowess to deliver smarter, more updatable electric cars over the coming years.

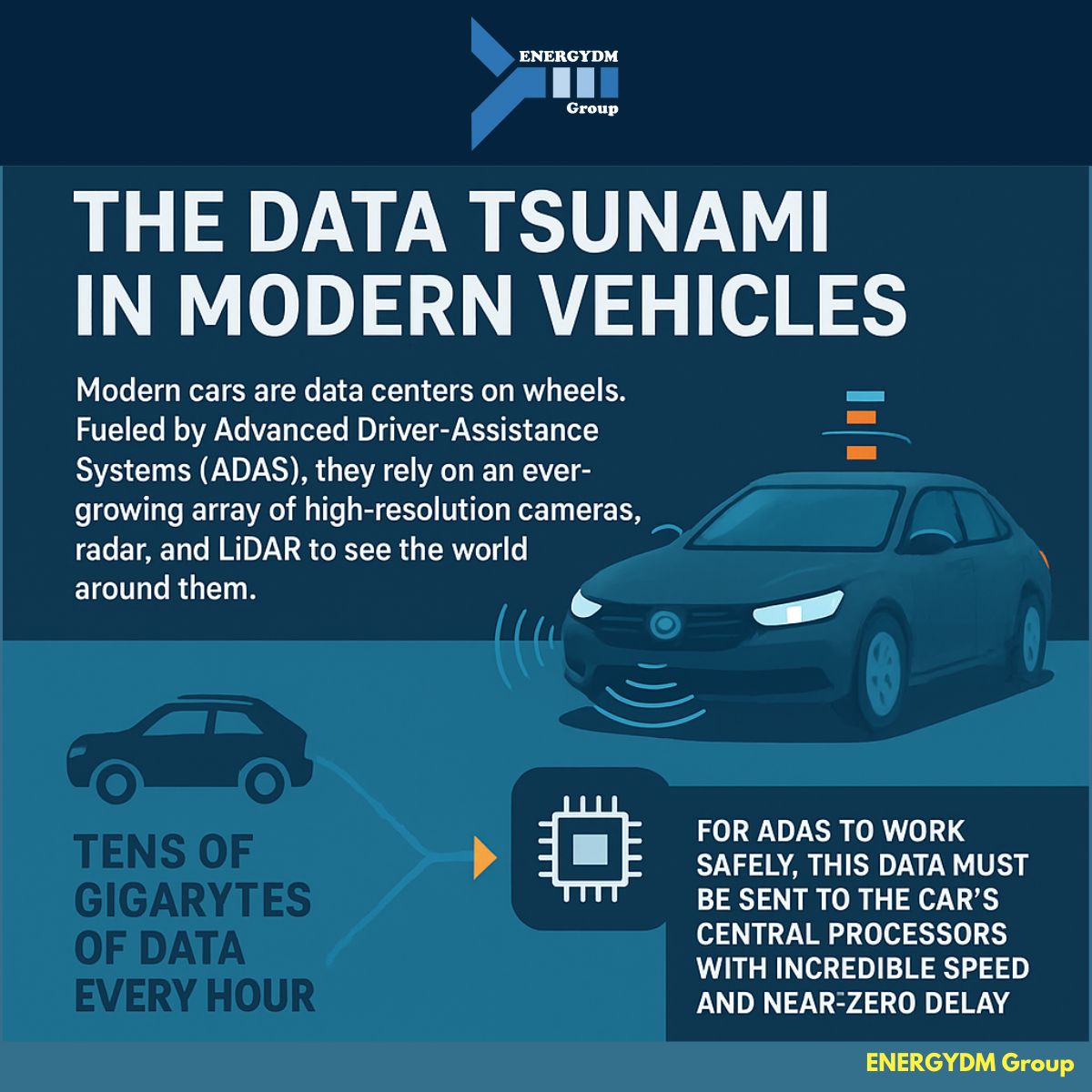

Unlike a typical alliance that might share entire car designs or factories, this venture is laser-focused on the digital platform inside the cars—essentially the vehicle’s “operating system” and electronics. Engineers from both companies are now working side by side in a new independent entity, co-led by Rivian’s Wassym Bensaid and VW’s Carsten Helbing, to co-develop the underlying software and electrical/electronic (E/E) architecture for their next-gen EVs. In simpler terms, they’re collaborating on the complex network of controllers, sensors, and software that makes modern cars tick—from infotainment systems to motor and battery management.

Scope of the JV

This joint venture covers a shared software and electronics stack for future EVs, but not every aspect of vehicle development. For instance, it will adopt Rivian’s so-called “zonal” electronics architecture—an approach that centralizes many electronic control units into a handful of high-powered domain controllers, reducing both hardware complexity and wiring length. The JV also aims to develop a common operating system that manages all vehicle functions and supports continuous over-the-air (OTA) updates. However, the partnership excludes crucial areas such as battery technology, electric motor R&D, chassis design, and even ADAS (advanced driver assistance systems). Both VW and Rivian will handle those application-level features separately, each crafting their own brand-specific driver assists and autonomous capabilities.

In practice, that means Volkswagen could embed its own user interfaces, brand identity, and autonomy software onto the underlying Rivian-derived “brain.” Meanwhile, Rivian’s consumer vehicles will do the same, resulting in each automaker offering unique experiences built on a common E/E foundation. This approach makes sense for accelerating development while still preserving brand differentiation.

Investment and Timelines

Volkswagen’s total outlay of $5.8 billion will fund the project through 2027, with some funds provided upfront and additional tranches contingent on technical milestones. For Rivian—a younger EV player that’s been burning through capital to ramp production—this is a major lifeline. According to Rivian CEO RJ Scaringe, the capital injection will ensure they can launch the more affordable R2 electric SUV in 2026 and scale manufacturing toward profitability.

Both companies have set an ambitious timeline. Rivian’s R2 will reportedly be the first model to use the joint venture’s software architecture when it launches in 2026. Volkswagen, in turn, plans to introduce its first vehicles on this platform around 2027, starting with models under the revived off-road brand Scout Motors. It also intends to apply the same foundational tech to a wide range of VW, Audi, and potentially Porsche EVs between 2027 and 2029.

What Volkswagen Gains

For Volkswagen, this deal is about solving its software challenges more quickly and effectively. The company’s software subsidiary, CARIAD, has struggled to unify digital systems across multiple VW brands, causing repeated delays and cost overruns. By partnering with Rivian, VW buys into a proven architecture—one that already underpins Rivian’s own R1T and R1S vehicles. This could help VW roll out “software-defined vehicles” that are easier to update, maintain, and monetize through app stores and subscription features. Ultimately, Volkswagen wants to close the gap with Tesla and other tech-savvy competitors, and tapping Rivian’s faster-paced innovation is a strategic shortcut.

What Rivian Gains

For Rivian, the benefits go well beyond the $5.8 billion investment. Securing a deal with one of the world’s largest automakers validates Rivian’s approach to software and electronics, showing that its platform is robust enough to power millions of cars worldwide. The startup can also diversify its business: it won’t just profit from selling its own trucks and SUVs, but also from technology licensed to VW. That could offset Rivian’s operational costs and help it sustain R&D at a time when many EV startups struggle with cash flow. In essence, Rivian becomes a critical enabler behind the scenes of mainstream brands, expanding its influence across the EV landscape.

Challenges Ahead

Despite the optimism, merging two vastly different corporate cultures and tech stacks is no small feat. Volkswagen is a century-old German automaker with multiple brands and a complex hierarchy, while Rivian is a California-based startup known for agility and risk-taking. Aligning their engineering teams and development roadmaps under one JV will require finesse. Any delays or technical hurdles in the shared software platform could impact the launch dates of both Rivian’s R2 and VW’s planned EVs, causing serious reputational and financial consequences. Moreover, there’s the question of how this joint venture coexists with VW’s own in-house software group, CARIAD. Officially, CARIAD will remain pivotal for areas like autonomous driving modules and legacy platform updates, but there’s a risk of overlap or internal turf battles that might slow progress.

Impact on CARIAD

CARIAD was founded to unify Volkswagen’s software approach, yet it has struggled under the weight of multiple brand demands and conflicting timelines. With the new JV taking center stage for future platforms, CARIAD’s role may gradually shift toward specialized functions—like integrating advanced ADAS algorithms or advanced data analytics—on top of the Rivian-based architecture. While that might relieve CARIAD of some pressure, it also hints at a partial loss of autonomy in steering VW’s overall software direction. How well CARIAD collaborates with the JV on handoffs between core architecture and brand-specific features could determine whether the partnership thrives or becomes mired in bureaucratic tension.

Looking Ahead

The Volkswagen–Rivian joint venture is one of the boldest collaborations in recent EV history. For VW, it offers a chance to accelerate software breakthroughs and ensure on-time, high-quality launches of next-gen electric models. For Rivian, it’s a lifeline of funding and a powerful stamp of approval from a global giant. Yet the stakes are high: if the JV succeeds, by the late 2020s we may see a wide swath of VW, Audi, Scout, and Rivian vehicles sharing core electronics while sporting unique brand personalities on top. If it falters, both sides could face costly delays in a hyper-competitive EV market. Either way, this partnership exemplifies the industry’s shift toward software-defined, upgradable cars, and it puts both companies on a faster track to that future—assuming their combined teams can execute under tight deadlines and big expectations.