Welcome to your quick and easy rundown of the hottest developments in the automotive world! From electrification challenges to hydrogen breakthroughs, we’ve got you covered with all the latest buzz that’s moving this industry forward.

1. Tesla’s 3-Year Low in Q1 Deliveries

The Scoop

Tesla’s global deliveries in Q1 2025 dropped to 336,681 vehicles, marking a 13% year-over-year plunge and the company’s weakest quarter in nearly three years.

Why It Matters

Tesla’s brand has been almost synonymous with EV leadership. But with competitors stepping up (and controversies swirling around Elon Musk’s statements), this slump raises big questions about Tesla’s market dominance and whether consumer sentiment could be shifting.

Our Take

It’s probably too early to declare a long-term Tesla downturn. Still, legacy automakers and emerging EV brands are catching up fast. If Tesla doesn’t address brand perception and keep innovating, it could cede serious ground in the next wave of EV adoption.

2. Infineon’s $2.5 B Auto Ethernet Acquisition

The Scoop

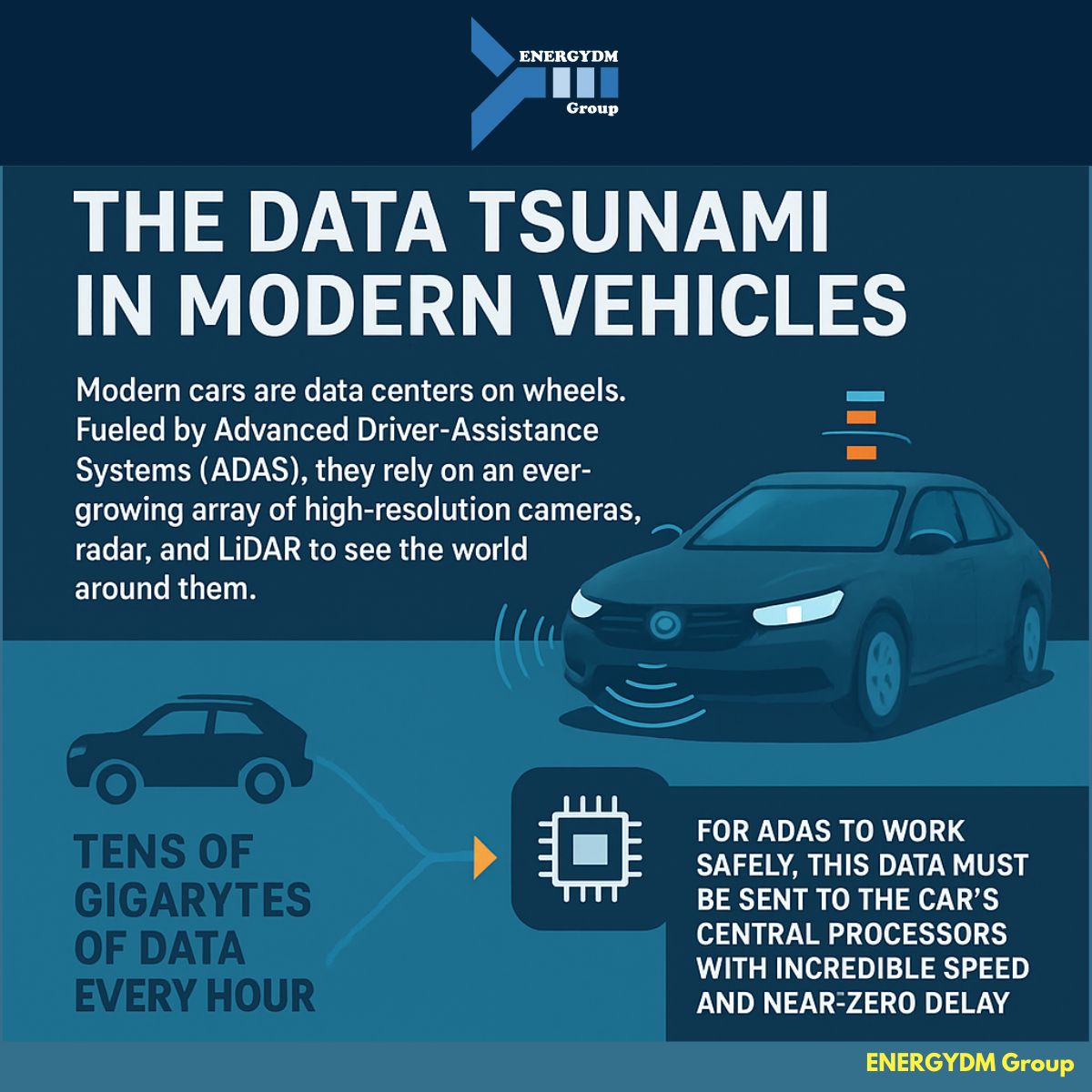

Infineon Technologies is buying Marvell’s Automotive Ethernet business for a hefty $2.5 billion, bolstering its chops in software-defined vehicles and next-gen in-car networking.

Why It Matters

Seamless data flow is the backbone of modern cars—especially EVs and autonomous vehicles. This move will let Infineon deliver more robust automotive microcontrollers, so the big winners could be automakers hungry for faster, safer connectivity.

Our Take

Think of cars as rolling computers. With bigger, more complex systems, acquiring advanced networking tech is huge. Expect Infineon to become a go-to supplier for OEMs aiming to offer premium infotainment, driver assistance, and over-the-air updates.

3. Toyota Plans 15 EV Models by 2027

The Scoop

Toyota, known for championing hybrids, is ramping up full EVs in a big way. They aim to launch 15 new electric models and hit 1 million annual EV sales by 2027.

Why It Matters

Toyota’s pivot toward pure EV signals how fast the market is changing. The company’s recognition that hybrids alone aren’t enough suggests global demand for battery-powered models is skyrocketing.

Our Take

Toyota was once criticized for moving too slowly on EVs. But with robust manufacturing networks and proven reliability, it has the potential to shake up the EV market—again. Keep an eye on whether Toyota can secure enough battery supply to fuel this expansion.

4. DeepRoute.ai & Qualcomm Team Up

The Scoop

Chinese self-driving startup DeepRoute.ai is collaborating with Qualcomm to develop high-level ADAS on the Snapdragon Ride platform, combining Lidar, cameras, and AI-based software stacks.

Why It Matters

As ADAS becomes more advanced (think highway autopilot and automated parking), the fusion of hardware + software + AI is critical. This partnership could accelerate mainstream adoption of robust, affordable driver-assistance features across many brands.

Our Take

Both established chip giants and ambitious startups are racing toward the same goal: making vehicles safer and semi-autonomous. Pairing DeepRoute.ai’s algorithms with Qualcomm’s scale might push ADAS further into everyday cars, not just luxury models.

5. Hyundai’s Hydrogen Nexo Gets a New Look

The Scoop

Hyundai unveiled a fully redesigned Nexo hydrogen fuel-cell SUV at the Seoul Mobility Show. It’s the first major overhaul for their flagship FCEV since 2018.

Why It Matters

While battery EVs dominate today’s headlines, Hyundai continues to invest in hydrogen. If the new Nexo shows improved range and reliability, it could help fuel-cell tech gain more credibility—especially in regions with robust hydrogen infrastructure (looking at you, Korea and Japan).

Our Take

It’s still a steep uphill for hydrogen in passenger cars, but Hyundai is betting on a future where FCEVs coexist with battery EVs. Long-haul trucking and commercial fleets might see the biggest advantage, but the Nexo’s redesign keeps consumer FCEVs in the conversation.

6. Hyundai Mobis Opens Giant Software R&D Hub

The Scoop

Hyundai Mobis expanded its Indian R&D operations into a 24,000 ㎡ mega facility in Hyderabad. It aims to ramp up software development for ADAS, EV powertrains, and next-gen mobility features.

Why It Matters

Software is the new “engine” of the auto industry. As more OEMs chase the “software-defined vehicle,” having dedicated R&D hubs, especially in tech-driven cities like Hyderabad, can speed up innovation and reduce costs.

Our Take

Hyundai Mobis is going big—literally. Consolidating resources into one mega-lab suggests they’re serious about taking a lead in global ADAS and EV software. This could attract top-tier software talent and help push Hyundai-Kia’s vehicles toward more advanced, integrated digital experiences.

Final Thoughts

Whether it’s Tesla’s struggles, Toyota’s EV push, or Hyundai’s hydrogen hustle, the automotive space is evolving at breakneck speed. This isn’t just about cars—it’s a race to define the next era of personal mobility, from connected software ecosystems to alternative fuels.

Which of these moves do you think will shake up the industry the most? Let us know in the comments, and stay tuned for more daily insights on the auto revolution!